The Future of P2P Lending

kw: Peer to Peer lending

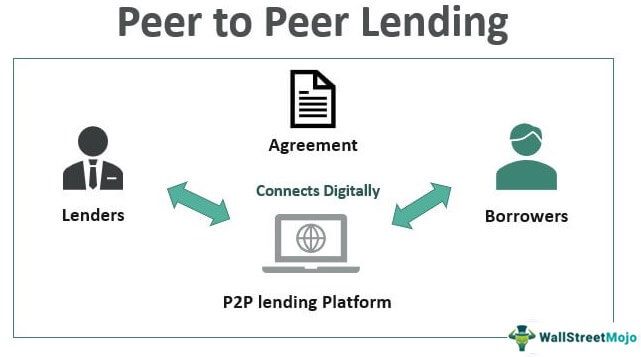

Today, in an era of economic crunch, obtaining a loan in a traditional way has become too difficult. Banks and financial organizations are hesitant in providing funds, even to individuals who have an excellent credit score. As a result, you might ask yourself how you can get a loan with an average credit rating. The answer is simple. You can take a loan from a peer to peer lending platform. These platforms are web-controlled systems in which the borrowers take loans straight from the lenders.

Peer to Peer Lending has Seen Major Progress.

P2P lending has seen notable growth over time. There are a large number of P2P lending platforms that operate from all around the world. This lending method has been serving the lenders and borrowers with great effectiveness. So the economic experts suggest that P2P lending is shaping the future of the global financial industry. This post will discuss the prominent aspects of this technique to guide you in which direction Peer to Peer lending is heading in the future.

The Future Of Peer to Peer Lending

The P2P Lending Sector is Expanding: The P2P lending system was simple from the start. It operated with the help of a P2P platform, lenders, and borrowers. But now, several P2P business models have become famous in the market. As a result, plenty of platforms are emerging to serve the burrowers in taking specific types of loans. They may provide loans that can assist the individuals in paying for invoice trading, property loans, and business loans. So in the future, you will get a chance to work with a broad range of P2P platforms.

Institutional Lenders are Increasing. There is an increase in the use of Peer to Peer lending by institutional lenders. They want to meet their investment goals to increase their earnings. On average, about fifty percent of Peer to Peer loans on a global basis are provided by institutional lenders, such as banks and brokerage firms. Other examples of these institutes can be pension funds providers and trusts. These loans can also originate from investment dealers and insurance companies. The interest rates may get very high for these loans in various markets.

Business Lending is Increasing. Business lending is one of the leading sectors in P2P lending, and it is foreseeable that it will make up a big percentage of the P2P market in the not-so-far future. Small to medium-sized organizations have to overcome considerable hindrances in gaining bank credit. That is why they will benefit from alternative financing methods to gather funds for their business.

There will be Regulations: The lack of regulations for Peer to Peer lending can lead to unfavorable results. Moreover, if the policies are too strict, it will be difficult for the whole sector to survive. So when regulating P2P lending, the government should take on a strategy that should be neither too strict nor too lenient.

P2P Lending will become an Integral Part of the World’s Economic System. Besides providing specific kinds of loans to certain types of customers in various niches, P2P lending has become an integral part of the world’s economic system. While institutional lenders provide huge amounts of P2P loans, the rule-makers are playing an essential role in making new control frameworks for the new Peer to Peer lending system.

Moreover, they are also focusing on integrating the present platforms in the already created setups. For example, the UK’s regulators have even added top P2P lending portals in the Covid Business Interruption Loan Scheme known as CBILS. They took this initiative after identifying the benefits of Peer to Peer lending portals. These platforms are generating a considerable cash flow towards small and medium-sized organizations. According to these aspects, P2P lending has a bright future, especially when there is a big demand for loans during the epidemic.

The Insight into the Post

A large number of consumers are opting for P2P lending services to fulfill their borrowing requirements. This preference is because of strict banking and credit card loan terms. That is encouraging the borrowers to search for alternate methods of investment. Because of these reasons, the P2P loan market is expanding. At the same time, institutional lenders and business borrowers are increasing. That is why it will be more important than ever to apply profit-promoting regulations in this sector. That will make Peer to Peer lending an integral part of the world’s economic system in the future. Also, read our lifestyle articles.